THE HEDGE FUND

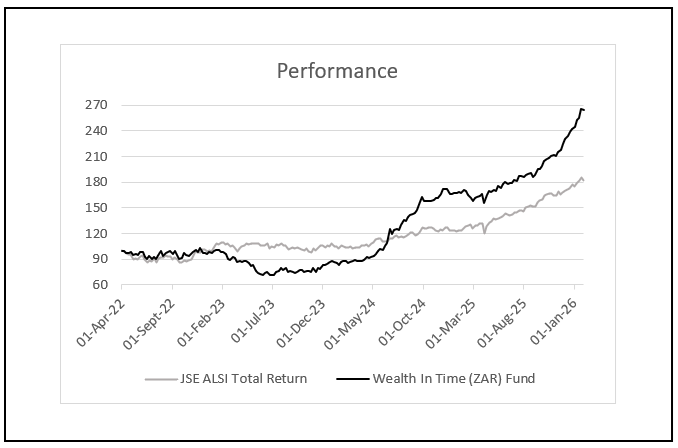

Source: FactSet and Peresec up to 30 January 2026. (Net of management fees, does not account for performance fees).

Investment philosophy

Hopefully you get a sense of my approach to investing from the rest of the website. However, if I had to try classify my style using more traditional terms, I would say I am closest to a Value investor (someone who buys stocks that are undervalued). Although I look at my own metrics, not the traditional Value metrics.

I do my own research, as I look for very specific things, that are mostly not focused on in industry reports.

I believe in debating your investments, and fortunately I have quite a few analysts and portfolio managers as friends and we debate investments regularly. Also my investors will often call and chat through investments.

I do a lot of macro economic reading, and research, which I apply when considering industries to invest in. While bottom up is important, the macro economic environment is in my view a fundamental consideration.

I am always skeptical, so it needs to be very clear, I don’t buy stories or “it could”.

I am consistent. I am not reactive (am decisive), I try not vary from what I know and I generally buy long term.

I keep it simple, and if I am wrong (not often in investing), I will tell you I am wrong.

investment principles

I think the most important thing in investing is Warren Buffett’s rule of “Don’t lose capital”.

I keep quite a concentrated portfolio. I invest in +-10-15 stocks, although I don’t apply a rule to the number of stocks.

I keep things simple, no fancy derivatives, just longs and shorts, bonds and equities. Which is would say is generally net long equities.

I use leverage, and this leverage is from either bond shorts or cash, or arises in a low risk long short.

I am not trying to be the benchmark. I am not chasing what the market does. I am not trying to just outperform a benchmark. My goal is to just make good investments, and allocate the most money to the best options.

I do try manage risk, through the make up of the portfolio. This mostly does reduce volatility (size of the ups and downs). That said I don’t necessarily mind short term volatility.

I would say so far this has worked quite well for me.

For more information please contact me (Carlos De Jesus) at: Wealthintime@gmail.com